Financial Institutions that focus on loan products juggle many variants to understand consumers and improve operational efficiency.

New lending technology offers solutions to:

-

- improve decision making transparency,

- provide better customer experience,

- offer better loans that meet customers’ needs, etc.

We’ve gathered the top seven digital lending software that will help your institution simplify lending service. But first, let’s understand what digital lending is and entails.

What is Digital Lending?

Digital lending refers to the online application and disbursal of loans where all processes, even loan approval and recovery, are digital.

The shift is part of the digital transformation pushed by the pandemic (1).

It allows organizations to speed up credit decisions and offer personalized loans, mobile banking, etc.

What is a Digital Lending Software?

A digital lending software is a new type of lending technology that allows financial institutions to create an enhanced consumer experience for borrowers. It gives clients access to a variety of product offerings through digital loan processes.

With a digital lending platform, the loan application can be completed online, even through mobile apps or digital lending app.

The point of sale becomes any place the client is.

What is Instant Lending?

Instant Lending is the new term that characterizes the use of automation technology to process loans in an express and fully digital way.

Instant Lending software allows financial institutions to go from submission to funding in as little as 10 minutes.

Explore Virtus Flow Instant Lending

Why financial institutions are becoming digital lenders

Through instant digital lending, institutions can improve their lending experience by:

- speeding credit checks and decision making,

- offering customized loans and lowering costs.

Not to mention the ability of financial institutions to reach a larger pool of potential customers and close deals from any place.

By speeding up the lending process, financial organizations are also able to better serve underbanked consumers.

Let’s now explore the top 7 digital lending solutions and platforms for banks, credit unions, and other financial institutions.

Virtus Flow Lending

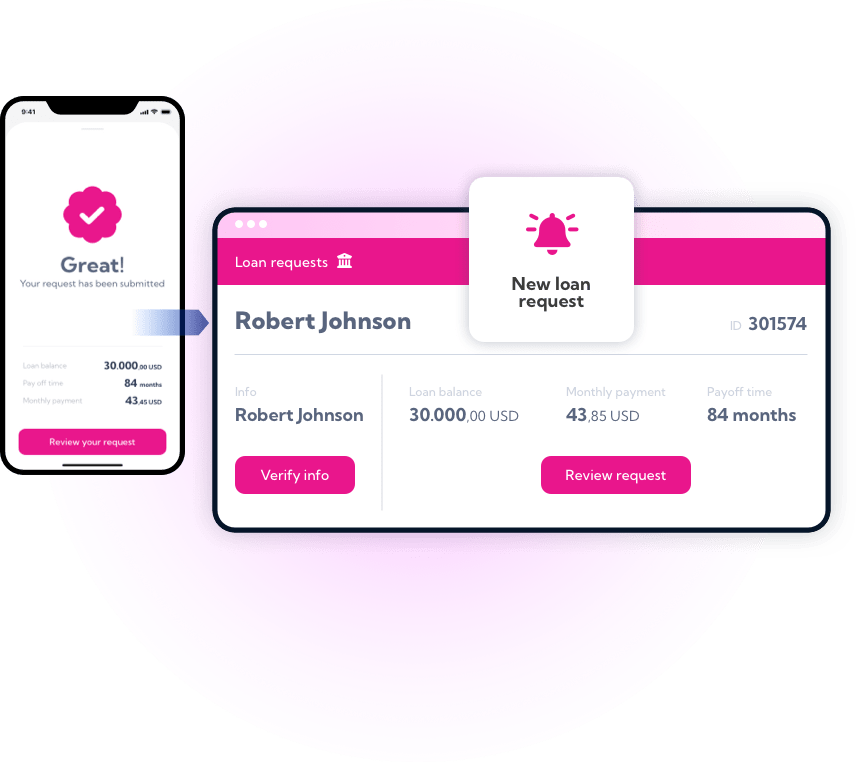

Virtus Flow Instant Lending allows financial institutions to digitize and customize their full lending processes. It enables financial institutions to close loans in as little as 10 minutes.

It’s able to streamline the full lending process: application, identity verification, credit scoring and funding.

What it provides

On the customer side:

-

-

- Online Application (web or app)

- Status of application

- Funding

-

On the Lending Department side:

-

-

- Automatic distribution by type of loan

- Instant identity verification

- Automatic contract generation

- 360º visibility over loan activity

- Simplify reporting

-

Relevant features

-

-

- Digital Loan Management dashboard

- Fully No-Code platform (allows to build and customize your unique loan workflows in hours)

- Integrated to Experian Credit Bureau

- Incredibly fast to deploy

- Digital documents (automatic contract generation and management, esignatures, etc)

-

Our partnership with Experian allows you to:

- have real time access to credit report and income

- authenticate identification documents in seconds

- do biometric analysis,

- reduce risk with multiple fraud controls,

- have a fully streamlined instant lending process.

Blend

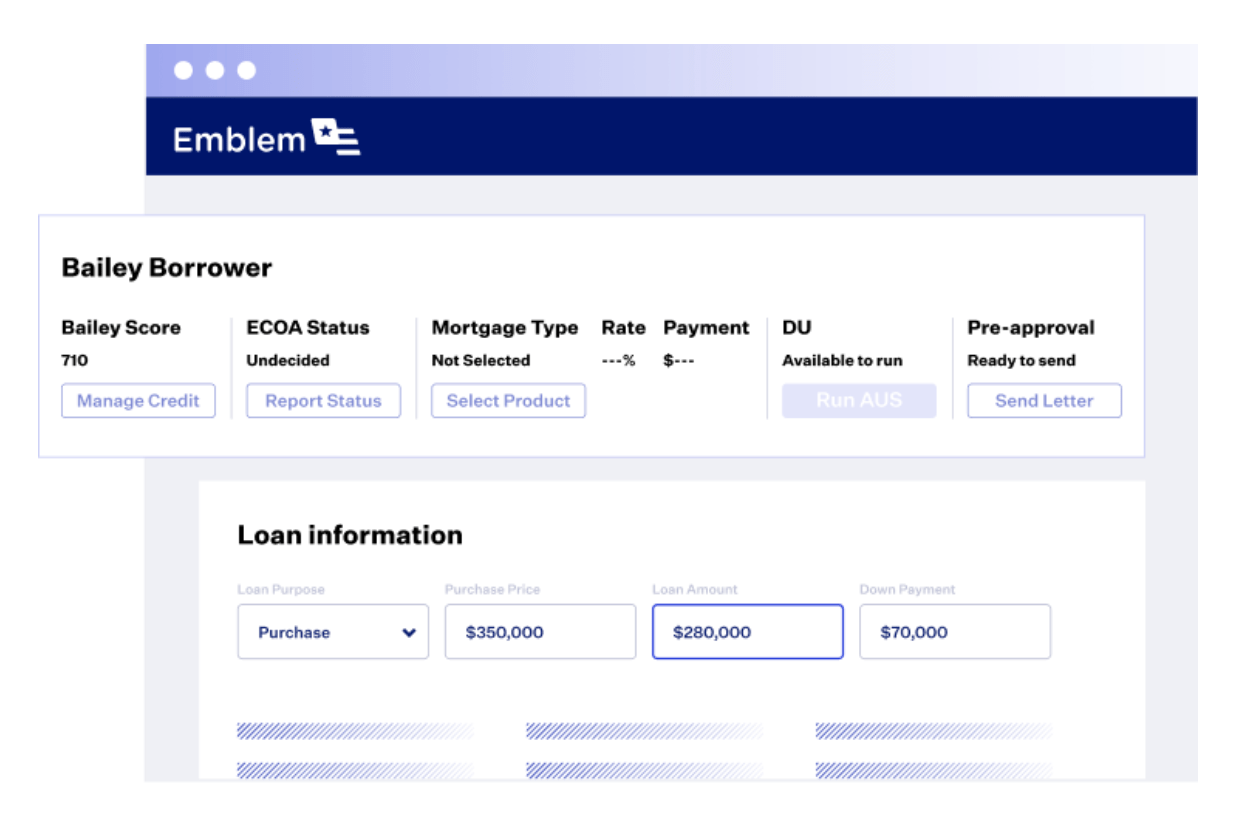

Blend helps banks unify their digital banking experience with two main platforms: a mortgage suite and a consumer banking suite.

Mortgage offers a platform for seamless digital journeys from application to close.

Consumer Banking helps financial institutions enhance experiences in loan applications, deposit accounts, lending products, and credit cards.

Relevant features

-

-

- Asset verification

- Income and employment verification

- Automated workflows

- CRM

-

Roostify

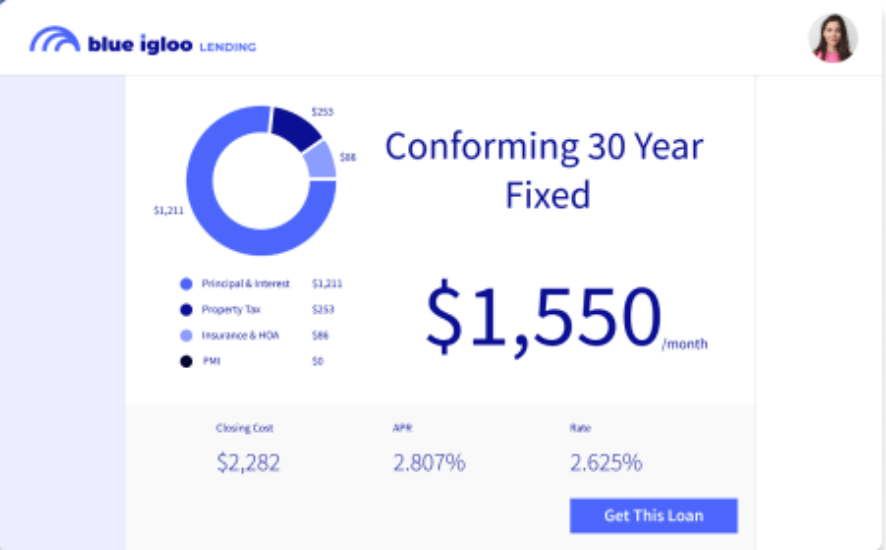

It offers a unified digital platform that simplifies the home buying journey: acquisition, application, fulfillment and closing.

Relevant features

-

-

- Brand Customization

- Custom workflows

- Self service tools

- Automated document review

-

Braviant

This lending platform helps financial institutions improve the customer journey by streamlining the borrowing process and transforming how people access their credit online.

Relevant features

-

-

- Automated verification process

- Real time underwriting

-

Stavvy

Stavvy simplifies mortgage lending, real estate and legal workflows by improving efficiency, collaboration and visibility in a unified platform.

Relevant features

-

-

- Loan servicing

- Loan origination

- Legal Services

- Title and settlement

-

Open Lending

This digital lending platform specializes in loan analytics, risk-based pricing, risk modeling and automated decision technology in the United States.

Relevant features

-

-

- Decisioning analytics

- Embedded CECL Treatment

- Pre-packaged third-party auto loan default insurance

-

PeerIQ

PeerIQ offers solutions for banks and credit unions that are looking to add credit data to their portfolio.

The solution also gives users the ability to manage their portfolios in real time with analytics and service reporting tools.

Relevant features

-

-

- Portfolio Management

- Due Diligence Tools

- Cash flow projections

- ALLL/CECL tools

-

Discover how to deploy fully digital loan processes in days!